Week Ahead: USDJPY timebomb flirts near “danger zone”

- Edge Account

- Market Analysis

- Week Ahead: USDJPY timebomb flirts near “danger zone”

- JPY ↓ over 1% versus USD year-to-date

- Japan last intervened in July 2024, spending $36.8 billion

- US PCE + Japan CPI + BoJ = fresh volatility?

- Over past year BoJ triggered moves of ↑ 0.8% & ↓ 0.2%

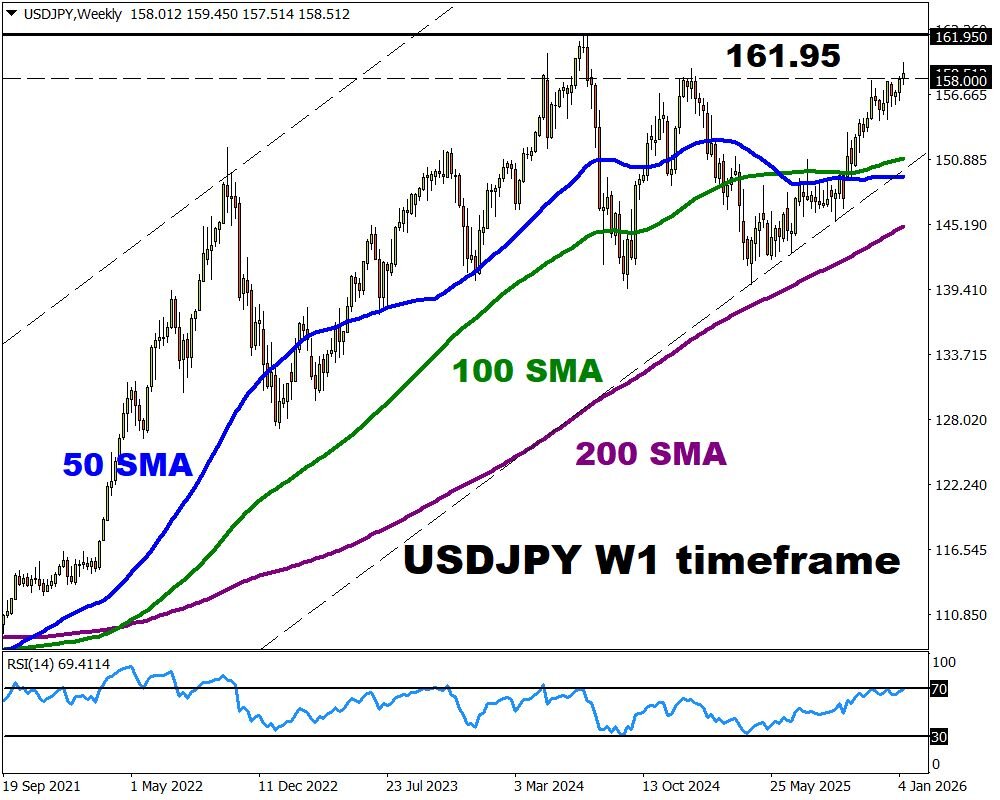

- Technical levels: 162, 160 and 158

Global FX markets could roar back to life if the yen descends deeper into intervention “danger zones”.

USDJPY is trading near an 18-month high around 158.50, a region that forced Japan to intervene back in July 2024.

To be clear, the government jumped into action after USDJPY almost hit 162.00, which is less than 2% away from current prices.

With chatter around intervention getting louder by the day, this could translate to heightened levels of volatility.

Beyond this key theme, the coming week also features scheduled events that could influence USDJPY:

Monday, 19th January

- US markets closed for Martin Luther King, Jr. Day

- Annual World Economic Forum in Davos

- CNY: China GDP Growth Rate (Q4); Industrial Production (Dec); Retail Sales (Dec)

- CAD: Canada Inflation Rate (Dec)

Tuesday, 20th January

- EUR: Germany PPI (Dec); Germany ZEW Economic Sentiment Index (Jan); Eurozone ZEW Economic Sentiment Index Jan)

- GBP: UK Unemployment Rate (Nov); Average Earnings

- USD: US ADP Employment Weekly Change

- WTI: API Crude Oil Stock Change (w/e Jan 16)

- US500: Netflix earnings

Wednesday, 21st January

- Trump’s speech at the World Economic Forum

- GBP: UK Inflation Rate (Dec)

- USD: Pending Home Sales (Dec)

- JPY: Japan Balance of Trade (Dec); Exports (Dec)

Thursday, 22nd January

- AUD: Australia Employment Data (Dec); S&P Global Manufacturing and Services PMIs (Jan)

- NZD: New Zealand Inflation Rate (Q4 2025)

- EUR: ECB Monetary Policy Accounts; Eurozone Consumer confidence (Jan)

- USD: US PCE Index (Oct, Nov); Personal Income and Spending (Oct, Nov)

- JPY: Japan Inflation Rate (Dec)

- WTI: US EIA Crude Oil Stocks Change (w/e Jan 16)

Friday, 23rd January

- GBP: UK Retail Sales (Dec); S&P Global Manufacturing and Services PMIs (Jan); Gfk Consumer Confidence (Jan)

- JPY: BoJ Interest Rate Decision

- EUR: Germany HCOB manufacturing PMI (Jan); Eurozone HCOB Composite, Manufacturing and Services PMIs (Jan)

- CAD: Retail Sales (Dec)

- USD: US S&P Global Composite, Manufacturing and Services PMIs (Jan)

The lowdown:

- The Japanese Yen is weakening due to election-related fiscal fears and political risk, while a stronger dollar is exacerbating the situation.

- A weak Yen is bad news for Japan because it boosts import costs, erodes purchasing power, and increases the cost of living.

- The country’s finance minister has warned speculators that Japan will act to defend its currency, while BoJ officials are paying more attention to its impact on inflation.

- Zooming out, expectations around a potential intervention may rattle FX markets and impact risk-sensitive currencies in addition to equities.

USDJPY set for a pivotal week?

Key events out of either side of the Pacific may rock the USDJPY:

1) US October/November PCE report

The incoming PCE figures are likely to shape interest rate expectations, especially the core PCE which is the Fed’s preferred inflation gauge.

On Thursday 22nd of January, both the October and November releases of the PCE reports will be published.

Traders are currently pricing in a 40% chance of a Fed cut by April with the odds jumping to 85% by June 2026.

- Signs of still sticky inflation may have Fed cut expectations, pushing the USDJPY higher as the dollar strengthens.

- A weaker-than-expected PCE report may pull the USDJPY lower as the USD weakens on rising Fed cut bets.

2) Japan CPI + BoJ rate decision

Japan's December CPI report published on Thursday may influence BoJ monetary policy expectations beyond January.

Inflation is forecast to have risen 2.2% year-on-year, down from 2.9% in November due to the base effects from the jump in fresh food prices and new fuel subsidies last year.

Regarding the BoJ, it is expected to hold rates steady at 0.75% but any clues offered on future rates may rock the yen.

Traders are currently pricing in a 25% chance of a BoJ hike by March with the odds jumping to 57% by April 2026.

- The Yen may rally if the BoJ strikes a hawkish note and signals a rate hike over the coming months. This may drag the USDJPY away from intervention danger zones.

- A cautious-sounding BoJ may weaken the yen, pushing the USDJPY deeper into intervention zones.

3) Technical forces

The USDJPY is firmly bullish on the daily timeframe with prices trading above the 50, 100 and 200-day SMA.

- A solid move above 159.00 may encourage an incline toward 159.50 and 160.20.

- Weakness below 158.20 could see prices slip toward 157.50 and 156.90.